Can Fiscal Policy have a Negative Effect? The Case of Lebanon

Following the 2008 financial crisis, many countries have resorted to government expenditure as a tool to boost aggregate demand. However, these policies have led to the buildup of considerable debt. Triggering local demand by boosting government expenditure sometimes backfires by triggering a sovereign debt or currency crisis leading to a decline in income and high unemployment level as in the 2009 Greek and the most recent Egyptian crises.

As such, the question of whether fiscal policy is a valid tool to counteract business cycle fluctuations and/or boost aggregate demand is worth examining, especially for developing countries which are the first to experience a cutoff of lending in the international credit market given lenders’ fear that political and legal institutions in place are weak to ensure compliance even with relatively higher debt obligations compared to those prevailing in developing countries.[1]

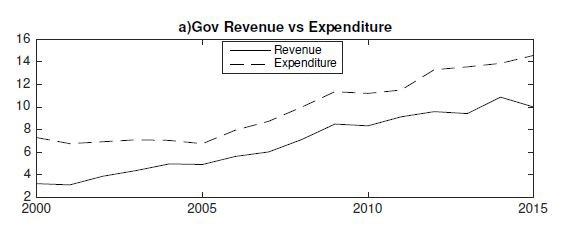

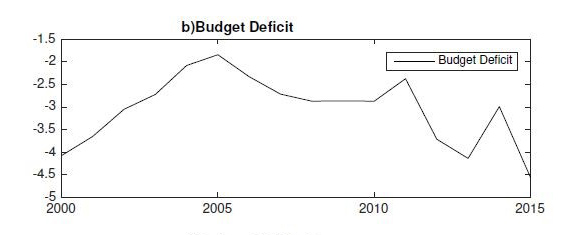

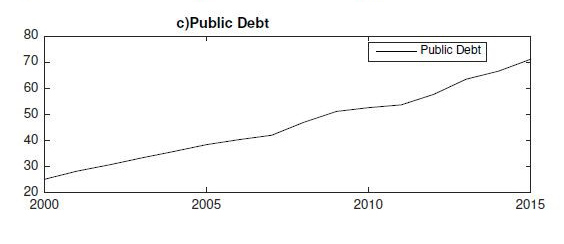

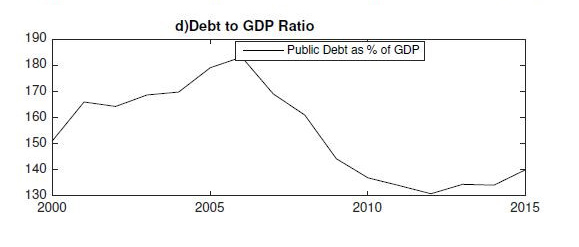

Since the early 2000, Lebanon accumulated a sizable amount of public debt. An uncontrolled spending coupled with corruption and inadequate collection of taxes widened the gap between government revenues and expenditures (Figure 1 (a)). Uncontrolled government expenditure along with a heavy debt service burden has led to a persistent budgetary deficit. By the end of 2015, Lebanon's public debt reached USD 71 Billion, about 140 % of it GDP (Figure 1(c) & (d)). However, an extravagant fiscal policy fueled by heavy borrowing in the domestic and international markets can’t go unchecked forever, by the time public debt achieves an unsustainable path; a sovereign-debt crisis usually ensues. Also, in retrospect, a 60 % debt-to-GDP threshold has been regarded as a debt cliff beyond which most debt and currency crises has been observed worldwide, Lebanon has surpassed the cliff by far.

Figure 1: Macroeconomic Developments in Lebanon (Billion USD)

Figure 1: Macroeconomic Developments in Lebanon (Billion USD)

Source: World Bank Database

So what does academic literature have to say about this? Nowadays, although most economists agree on the effect of monetary policy on employment and inflation, empirical research on fiscal policy effect shows mixed results. By way of example, Ilzetzki et al. (2013)[2] explored the question of government multiplier and came up with mixed results. For countries operating under fixed exchange rate and low trade to GDP ratio, fiscal multiplier is of magnitude of 1.4 and 1.1 respectively. In non-technical words, this means a 1-dollar spent by the government leads to more than 1-dollar increase in aggregate demand. However, for countries operating under flexible exchange rate or open to trade, the multiplier is negative. For countries with high debt burden (above 60 % of GDP), government expenditure is counter-productive of magnitude of -3.

Therefore, gauging the fiscal effect has no universal answer; it is case-by-case analysis that hinges on country’s characteristics like monetary policy, debt sustainability, openness to trade, and most importantly consumption behavior since it occupies the largest portion of aggregate income.

When it comes to the Lebanese case, government expenditure effect is examined and findings point to a negative effect of fiscal policy on GDP, whereas a positive impact on interest rate. Furthermore, multiplier effect was found to be 0 on impact and −0.5 over the horizon of three years, after which the impact vanishes. Interestingly enough, the latter implies that government expenditure has a counter effect on aggregate demand. But, how come we have arrived at a negative fiscal expenditure effect when most theories behind fiscal policy assert a positive impact of the latter on GDP?

In order to understand the reverse effect of government expenditure, it is beneficial to remind ourselves that a positive fiscal multiplier is derived under a Citrus Paribas condition i.e. when government expenditure does not interplay with other economic forces at play. However, other things not equal, investment and trade account can respond to government shocks negatively and more than reverse the initial effect of government expenditure to render the fiscal multiplier negative. This happens when the government is actually competing with the public sector to finance its expenditure. The latter manifests itself by an increase in the interest rates and, therefore, crowds out investment. Further, government expenditure can also trigger trade deficits by reducing national savings; this is what is referred to as “Twin Deficit” hypothesis in literature. Combining the effect of twin deficit and the effect of crowding out Investment reverses the initial effect of fiscal policy. Let alone the effect of fiscal policy on consumption, which in turn, hinges on how economic agents interpret government expenditure shocks. If economic agents interpret government expenditure passively by invoking concerns about sustainability of government debt, then it increases uncertainty about the future, and a fiscal expenditure shock will boost precautionary saving and, therefore, reduces consumption levels.

To recapitulate, fiscal policy in Lebanon is conducted with non-Keynesian features i.e. fiscal policy does not boost aggregate demand. On the contrary, it has a counteract effect given a high public debt, the existence of a unidirectional causal relationship between the budget and current account deficits, and a crowding out effect on Investment. Further, our results’ policy implications is two-fold; government officials and policy makers should refrain from using fiscal policy as a tool to counteract business cycle fluctuations or boost aggregate demand. In the latter context, mere exercise of fiscal policy can trigger a BOP type of crisis or invites a sovereign debt crisis by deviating the debt path to an unsustainable one.

[1] Obstfeld, Maurice, and Kenneth Rogoff. "The intertemporal approach to the current account." Handbook of international economics 3. [Online].1995. Available at http://dx.doi.org/10.1016/S1573-4404(05)80014-0

[2] Ilzetzki, Ethan, Enrique G. Mendoza, and Carlos A. Végh. "How big (small?) are fiscal multipliers?" Journal of Monetary Economics 60, no. 2 [Online]. 2013. Available at http://dx.doi.org/10.1016/j.jmoneco.2012.10.011

Nasser Badra is a research assistant at the Economics Department, American University of Beirut (AUB).

The views expressed here are solely those of the author in his/her private capacity and do not in any way represent the views of neither the Arab Development Portal nor the United Nations Development Programme.