Banking and Finance

The Arab banking sector continues to contribute significantly to the growth of Arab economies. The consolidated assets of the Arab banking sector amounted to around USD 4.4 trillion in 2022 up from 3.4 trillion by mid- 2018, making up about 150 percent of the region’s GDP. While the total deposits of the Arab banking sector amounted to USD 2.85 trillion Arab banking sector has financed the Arab public and private sectors with approximately $2.8 trillion, representing 90% of the size of the Arab economy.[1] The total value of assets held by the four largest banking sectors; namely the Emirati, Saudi, Egyptian, and Qatari, respectively, exceeded $0.5 trillion. By the end of 2022, the assets held by each of the two largest Arab banking sectors may surpass $1 trillion.[1]

Financial inclusion [*] in the Arab region has been historically low compared to other regions.[2] The region’s account ownership for persons over 15 years stands around 40.21 in 2021 up from 37 percent in 2017, well below the world average of 76.2 percent. Women are particularly excluded, with only 31.26 percent of women reporting owning an account at a bank or another type of financial institution or personally using a mobile money service, compared to the global average of 73.9 percent.[3] Account ownership, however, is quite high in the GCC countries, reaching 86.7 percent in the United Arab Emirates and 75.4 percent in Bahrain according to the latest available data; while in Yemen only 5.44 percent of adults reported having an account. Similarly, the Arab region lags behind other regions in terms of access to credit from formal financial institutions, with only 10 percent of persons over 15 years having borrowed from a formal financial institution or using a mobile money account, compared to the world average of 29 percent. The rate ranges from 32 percent in Saudi Arabia to 2 percent in Yemen.[3]

Moreover, although small and medium enterprises (SMEs) play a major role in the economies of Arab countries, access to finance is one of the greatest challenges facing SMEs in the region, where only one in five has a loan or line of credit. In general, the percentage of firms with a bank loan or line of credit is at 42 percent in Tunisia compared to only 4.4 percent in Egypt.[5] There is a great potential for the Arab region to expand financial inclusion that is still hindered though by the deficiencies in the financial infrastructure and regulatory frameworks that increase the costs and risks associated with increasing access to finance.

When assessing financial depth [**], major discrepancies appear across Arab countries. The total bank deposit to GDP ratio is the highest in Qatar at 110 percent, and the lowest in Sudan at 16.9 percent according to the latest available data. The private sector credit to GDP ratio [***] which is also a reference of the role/size of the private sector in the national economy, ranges between 7.89 percent in Sudan to 137 percent in Qatar.[5]

Islamic finance [****] has grown rapidly over the past decade; for example, the gross assets of Islamic banks operating in the UAE grew 7.31 percent to $177 billion by the end of the first quarter of 2023. Saudi Arabia is the largest Islamic finance market with assets of over $830 billion[7]. Around 50 percent of the Islamic financial institutions are located in the Arab region[1], mostly located in Sudan, Iraq, and Bahrain.[1][6]

This overview has been updated by the ADP team based on the latest available data as of August 2023.

Sources:

[1] Union of Arab Banks. 2023. The First Arab Forum for Banks & Businessmen 2023. [ONLINE]. Available at: https://uabonline.org/event/the-first-arab-forum-for-banks-businessmen-2023/ [Accessed 17 Aug 2023] and Mubasher.info https://english.mubasher.info/news/4055407/Consolidated-assets-of-Arab-banking-sector-may-reach-4-4trn-by-year-end/.

[2] The World Bank. 2023. The Global Findex Database 2021 and WDI 2023 [ONLINE] Available at: https://globalfindex.worldbank.org/ [Accessed 17 August 2023].

[3] The World Bank. 2020. The Global Findex Database 2017. [ONLINE] Available at: https://globalfindex.worldbank.org/ [Accessed 28 May 2020].

[4] The World Bank. 2023. The World Bank Enterprise Surveys. [ONLINE] Available at: https://www.enterprisesurveys.org/Custom-Query [Accessed 17 August 2023].

[5] The World Bank. 2023. The Global Financial Development Database. [ONLINE] Available at: https://www.worldbank.org/en/publication/gfdr/data/global-financial-development-database [Accessed 17 August 2023].

[6] Union of Arab Banks. 2019. Recent global development of Islamic banking and finance. [ONLINE]. Available at: http://www.uabonline.org/en/research/financial/recentglobaldevelopmentsofislamicbanking/7471/1 [Accessed 28 May 2020].

[7] Arab news. 2023. UAE In-Focus — Islamic banks. [ONLINE]. Available at: https://www.arabnews.com/node/2324811/business-economy [Accessed 17 August 2023].

[*] Financial inclusion refers to the access of individuals and businesses to useful and affordable financial products and services.

[**] Financial depth captures the financial sector relative to the economy or the size of banks, other financial institutions, and financial markets in a country, taken together and compared to a measure of economic output.

[***] Defined as the financial resources provided to the private sector by commercial banks and other financial institutions as a share of GDP.

[****] Islamic finance refers to the provision of financial services in accordance with Islamic jurisprudence (Shari’ah).

Data Highlights

-

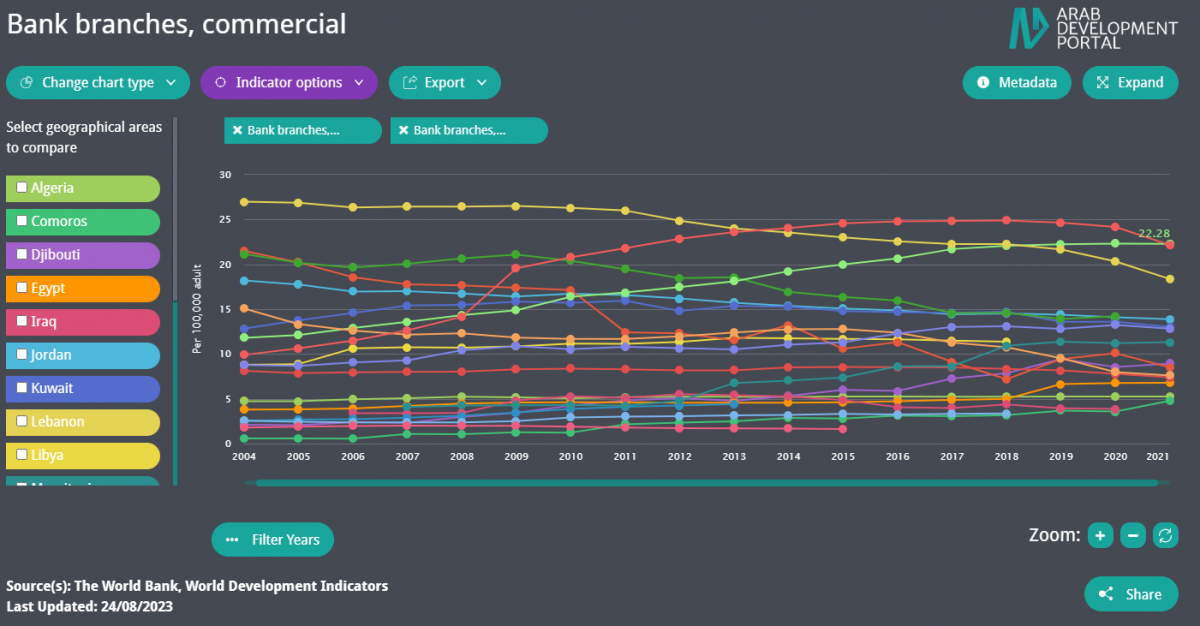

Morocco and Tunisia hold the highest number of commercial bank branches per 100,000 adults (more than 22 ) in the Arab region.