Macroeconomy

The macroeconomic outlook widely varies across Arab countries with exogenous and endogenous factors affecting the performance of countries over time. The role played by oil and gas and the impact of protracted conflict are among the main factors behind such sharp variation in the region. In addition to the impact of COVID-19 on the Arab economies that was already grave. According to UNDP (2021), the outbreak of COVID-19 in 2020 cost the Arab countries around 4.5 percent of their collective GDP, with the most affected sectors being the tourism industry and the service sector.[1]

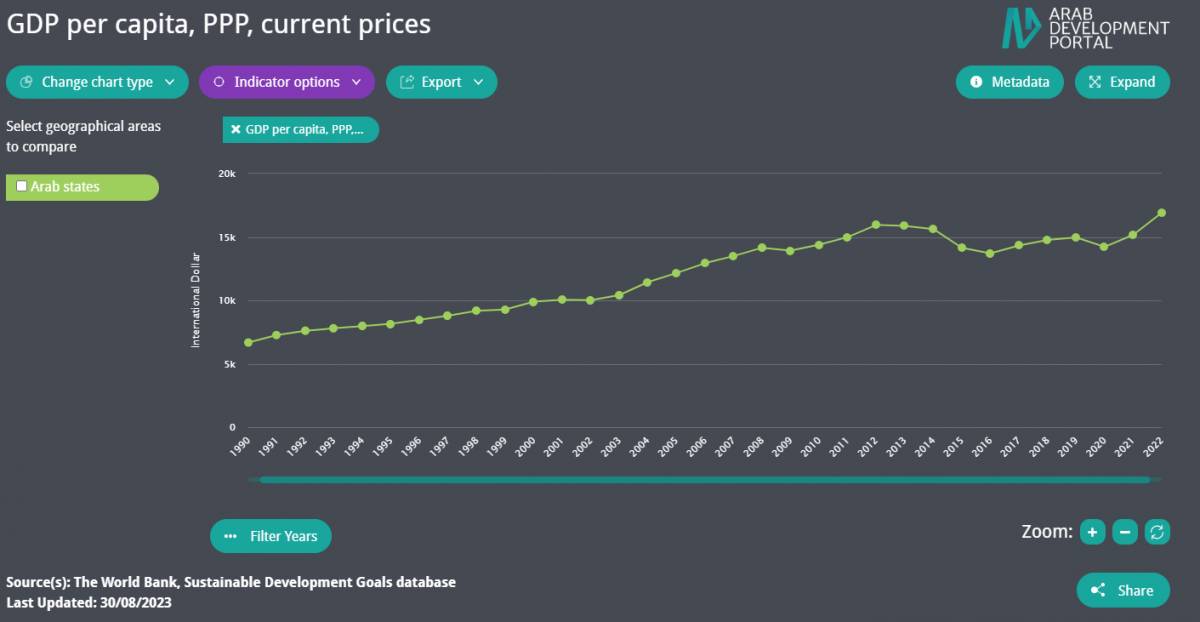

The Arab region includes countries with the highest growth rates and highest GDP per capita levels in the world, as well as some among the lowest GDP per capita levels worldwide. The GDP per capita (PPP constant 2017 international prices) for the Arab region averaged US$ 14324.4 in 2022 compared to the global average of US$ 17485.9. The variation is huge within the region: Qatar holds one of the highest GDP per capita levels in the world (US$ 97096.9) while Somalia holds one of the poorest in the world (US$ 1155.27).[2]

Oil and natural gas have played a significant role in such divergence across the region and in shaping the structure of the economies. On average, oil and gas represent between 30 to 60 percent of Arab countries’ total GDP. Oil revenues constitute 47 percent of government fiscal revenues for Yemen and 97 percent for Iraq with GCC (Gulf Cooperation Council) countries ranging between those two figures.[3] Sudan and Libya are similarly dependent on oil and/or gas in their economies. The percentage of oil rents to GDP in the Arab region is the highest in the world with an average of 17.13 percent, compared to the global average of 1.32 percent in 2021, peaking at 42.78 and 56.37 percent in Iraq and Libya respectively.[4]

Even in oil-importing economies, the indirect effect of remittances created by oil rents confirms the sensitivity of the majority of Arab countries to oil and gas rents: remittance inflows exceeded US$ 68.59 billion in 2022, making the Arab region one of the largest regions in the world in terms of sending and receiving remittances.[4]

The Arab region recorded an average of 5.9 percent GDP growth rate in 2022 [4] compared to the global average of 3.08 percent [4] The recent collapse of oil prices in 2020 deepened the recession caused by COVID-19 in the Arab economies. However, The International Monetary Fund (IMF) latest projections for 2024 are almost optimistic for all Arab countries, envisioning positive growth rates ranging from 1.84 percent in Qatar to 8.4 percent in Libya.[5]

Public finance disparities are also wide. The general government net lending/borrowing projected figures for 2023 reveal that Egypt, Algeria, and Bahrain will suffer the largest deficits in the region, between 7 and 9 percent of GDP in 2023, whereas Kuwait, Libya, and Qatar will enjoy budget surpluses of 7.04, 9.71, and 14.73 respectively.[5] Similarly, the general government gross debt as a percentage of GDP is expected to vary from 3 percent of GDP in Kuwait to 151 percent in Lebanon in 2023. [5]

Wide differences also prevail in foreign direct investment net inflows (FDI, BoP current US$) amongst Arab countries and over time. For example, United Arab Emirates ranked first in the Arab region in attracting FDI with more than US$ 10.3 billion in 2018 and 20.66 billion in 2021, while Iraq had a negative inflow exceeding US$ 4.8 million in 2018 and 2.6 in 2021.[4]

In sum, Arab countries display wide disparities in their macroeconomic performance within the Arab region but also compared to global performance. The exact scale of these disparities may be uncertain, due to gaps in the economic data in conflict-affected countries, the expected growth of the informal and war economies, and the disruption of the work of public institutions including national statistics bodies.

This overview has been drafted by the ADP team based on the most available data as of August 2023.

Sources:

[1] United Nations Development Programme). 2021. The Impact of COVID-19 on Arab Economies: What can we see. [ONLINE] Available at:

https://www.undp.org/arab-states/publications/impact-covid-19-arab-countries-what-can-we-see [Accessed 8 August 2023].

[2] United Nations Conference on Trade and Development (UNCTAD). 2023. [ONLINE] Available at: https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx [Accessed 8 August 2023].

[3] Ghoneim, Ahmed Farouk. 2020. Exploring the Potential Impact of COVID-19 on Trade in the Arab Region, op-ed for Arab Development Portal. [ONLINE] Available at https://arabdevelopmentportal.com/blog/exploring-potential-impact-covid-19-trade-arab-region

[4] The World Bank. 2023. World Development Indicators. [ONLINE] Available at: https://databank.worldbank.org/source/world-development-indicators/preview/on [Accessed 8 August 2023].

[5] International Monetary Fund. 2023. World Economic Outlook Database. [ONLINE] Available at: https://www.imf.org/en/Publications/WEO/weo-database/2023/April [Accessed 8 August 2023].

Data Highlights

-

The Gross Domestic Product per capita, purchasing power parity (current international dollars), of the Arab region